Safe Harbor matching contributions ensure employees receive a guaranteed employer match to their retirement savings, reducing the risk of non-discrimination testing failures. This benefit encourages higher employee participation and savings rates, ultimately enhancing retirement security while providing tax advantages for employees and employers.

What Is Safe Harbor Matching?

Retirement savings is one of the most critical aspects of financial planning. A helpful tool businesses may utilize to increase their workers’ retirement savings is the Safe Harbor 401(k). Safe Harbor Matching involves employers contributing a certain percentage of an employee’s salary to their retirement account. This feature is designed to encourage higher employee participation rates by offering a compelling incentive. By making it easier and more beneficial for employees to save, companies can ensure a more stable financial future for their workforce.

How Does It Work?

The mechanics of Safe Harbor Matching are straightforward yet impactful. Employers make matching percentage contributions to their 401(k) plans on behalf of their staff members; that is, the employer matches the amount contributed by staff members for every dollar they contribute. Most commonly, this includes formulas like dollar-for-dollar matching up to a specific percentage—often 3% to 5% of the employee’s salary. This matching can significantly enhance the total amount accumulated in the retirement fund over time, offering employees a substantial increase in their savings with relatively minimal effort. The simplicity of the structure also makes it easy for employees to understand and appreciate the benefits they are receiving.

Benefits for Employers

Increased Participation

One of the primary benefits for employers is the increased participation in the company’s 401(k) plan. Employee participation and salary contribution are more likely when employees know their donations will be matched. This higher participation rate can lead to a more financially secure workforce, improving employee morale and job satisfaction. A motivated and economically secure workforce is often more productive and loyal, reducing the costs associated with high turnover rates.

Tax Advantages

Another significant advantage is the tax benefits. Employers’ contributions to their employees’ 401(k) plans are often tax-deductible, which can provide substantial financial relief to the company. Additionally, achieving Safe Harbor status can help employers avoid specific non-discrimination testing, simplifying the plan administration process. Avoiding these tests reduces administrative burdens and ensures highly compensated employees can contribute the maximum allowed amounts to their retirement plans without restrictions, benefiting the company’s leadership and senior staff.

Advantages for Employees

The benefits of Safe Harbor Matching are manifold for employees. The most apparent advantage is the boost to their retirement savings without requiring them to increase their financial contributions. This additional employer contribution can be a powerful incentive to save earlier and more consistently.

For example, under a dollar-for-dollar matching plan, an employee making $50,000 per year who contributes 5% of their pay to their 401(k) would receive an employer match of the same amount. Over several years, this matching can add significant value to their retirement savings, showcasing the long-term benefits of participating in such programs. Even employees who are younger or less focused on retirement realize the benefit as more than just a perk but as a significant and impactful part of their financial planning.

Compliance Requirements

To qualify for Safe Harbor status, employers must comply with specific requirements. This includes making the promised contributions promptly and ensuring all eligible employees receive these benefits. According to IRS guidelines, contributions must generally be made at least annually and must be fully vested when contributed. Meeting these compliance requirements helps protect the employer and the employee, ensuring funds are appropriately managed and allocated. Adhering to these regulations keeps the company in good legal standing and demonstrates a commitment to ethical and responsible management of retirement funds.

Common Misconceptions

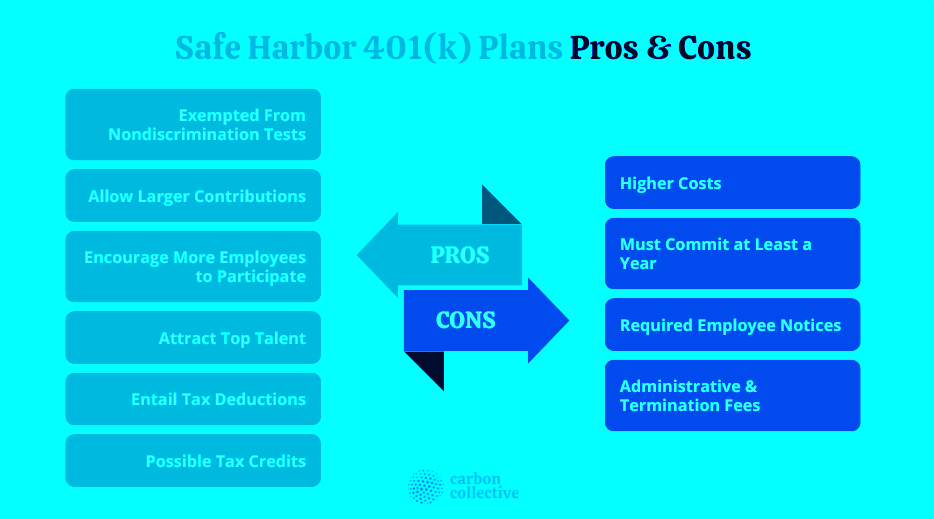

Several things could be improved surrounding Safe Harbor 401(k) plans. One widespread belief is that these plans are only beneficial for large corporations. However, because Safe Harbor Matching may be a compelling feature for attracting and keeping people, small and mid-sized organizations stand to gain much from its implementation. Many small businesses mistakenly assume that the costs associated with Safe Harbor Matching are prohibitive, but in reality, the tax advantages and improved employee retention often outweigh the initial expenditures. An effective retirement plan may help smaller businesses stand out and attract top applicants in an increasingly competitive labor market.

How to Implement Safe Harbor Matching

- Plan Design: The first step is to design a plan that fits within your company’s financial capabilities. This involves deciding on the matching formula and ensuring it aligns with your business objectives. Plan administrators or financial advisors can assist in customizing the plan to achieve specific company objectives.

- Clear Communication: Educating employees about the benefits and specifics of the Safe Harbor Matching is crucial for maximizing participation. Use channels such as meetings, emails, and informational brochures to convey this information. Regular workshops or one-on-one sessions can be efficient in helping employees understand the long-term benefits of the plan.

- Ensure Compliance: Constant monitoring and ensuring your plan aligns with legal requirements is vital. Review the plan regularly to make necessary adjustments and track regulatory changes. Audits and periodic reviews by external experts can also ensure the plan remains compliant and beneficial for all parties involved.

Real-Life Examples

For example, suppose a mid-sized business offers a dollar-for-dollar match of up to 5% of an employee’s pay. An employee earning $60,000 who contributes 5% of their salary to their 401(k) would receive an additional $3,000 annually from the employer. Over a decade, this has resulted in significant boosts to their retirement fund without accounting for investment growth. According to recent reports, such matching strategies are gaining popularity, providing long-term financial benefits to employees.

A real-world example can be seen in companies that have implemented these matching strategies and noticed considerable employee retention and satisfaction improvements. Employees at these companies often feel more valued and secure in their financial futures, leading to a more engaged and motivated workforce. These long-term advantages highlight the value of Safe Harbor Matching as a tool for businesses trying to enhance the work environment.