Rich Dad Poor Dad Review – Chapter in Kiyosaki believes that many people are living a rat race, working hard for salaries to cover bills while not truly getting ahead. Meanwhile, rich individuals make their money work for them by purchasing assets with passive income streams that generate passive income streams.

He shares lessons of financial literacy and wealth creation by drawing lessons from his two fathers’ stories. The book disproves the popular misconception that you need a high-income job to be rich, explains why your home does not count as an asset, among many other points of discussion.

The Story

Kiyosaki shares his story about two influential father figures – Poor Dad and Rich Dad. Poor Dad was Kiyosaki’s biological father who believed in pursuing an education and finding employment with higher wages to secure financial security. Rich Dad believed otherwise and encouraged Kiyosaki to achieve financial freedom.

Rich Dad was Kiyosaki’s best friend’s father, who championed financial literacy and an alternative path to wealth accumulation, emphasizing asset acquisition and investing in real estate as means for building wealth rather than solely earning high incomes.

Rich Dad Poor Dad Review – Chapters provides readers with an introduction to money and its workings, the distinctions between assets and liabilities, the barriers people face in becoming wealthy – fear, cynicism and laziness among them – as well as lessons on overcoming fear to pursue your goals and inspiring readers to follow your dreams.

Chapter 1: The Rich Don’t Work for Money

Kiyosaki begins Chapter 1 by outlining the main ideas and themes of his book. He describes how many people find themselves caught up in an endless cycle of working hard just to pay their bills but without enough left over for savings or investing, then goes on to discuss financial literacy and wealth-building as keys for long-term financial health.

Kiyosaki emphasizes the significance of making money work for you, not the other way around, through his analysis of both his fathers’ philosophies. He stresses the distinction between assets and liabilities; for instance highlighting why most homes don’t really qualify as assets despite our misconceptions; encouraging readers to think big; try volume discounts; think outside the box when it comes to thinking big – all these principles will enable readers to build wealth quickly and achieve financial independence.

Chapter 2: Why Teach Financial Literacy

Kiyosaki describes the differences in his two fathers, both of whom had different views about money and finances. One was educated yet struggled financially while his counterpart never completed eighth grade schooling.

Kiyosaki challenges conventional wisdom that advocates pursuing high-paying jobs or college in order to become rich. He instead advocates financial education as a way out of the rat race and building wealth.

He provides readers with the knowledge needed to differentiate assets and liabilities, and advises them why investing in real estate or other income-producing assets is beneficial. Furthermore, he advises them to calculate how much income they require annually before purchasing assets that offer that return at or above it in order to reach financial independence more quickly.

Chapter 3: Assets vs. Liabilities

Kiyosaki’s poor father (his biological father) taught him the value of staying within your comfort zone and studying hard in school to earn good grades and secure employment with steady pay; later, his rich dad encouraged diversifying your interests so you can become an expert in various fields.

Kiyosaki emphasizes in this chapter how rich people use money strategically; they acquire assets that increase their income. On the other hand, poor and middle class people typically use all their earnings on expenses and buy liabilities that only increase them further. He introduces cash-flow diagrams while discussing why personal residence may not qualify as an asset as well as some of the common mistakes people make with their finances.

Chapter 4: Taxes vs. Corporations

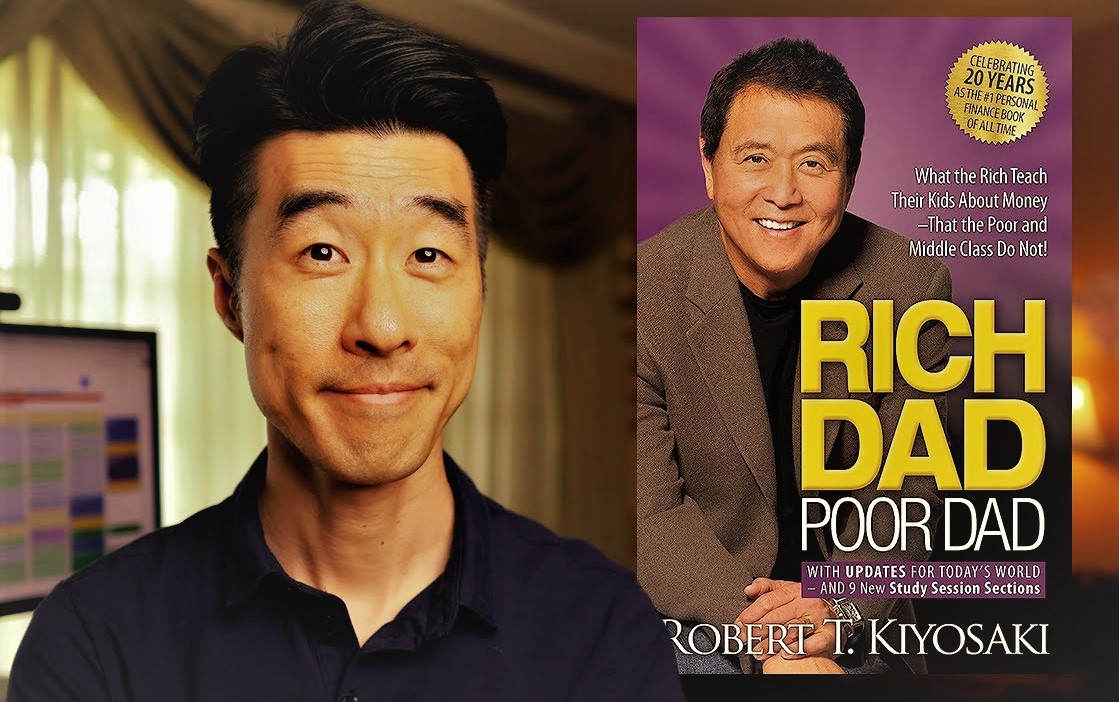

Rich Dad Poor Dad remains one of the most iconic financial books. Published first in 1997, its publication revolutionized how people thought about wealth building and investing.

Kiyosaki describes his own experiences of growing up with two father figures who each held drastically differing financial philosophies. Poor Dad was his biological father and believed in conventional wisdom such as earning a college degree, finding employment quickly, and counting on a steady paycheck for security. Kiyosaki recalls being subjected to both men’s influence while developing his financial strategies.

Rich Dad was his best friend’s father who taught Kiyosaki six lessons about money and becoming wealthy through owning businesses and real estate investments. Rich Dad taught Kiyosaki these valuable life lessons about becoming successful financially.

Chapter 5: Investing

Kiyosaki contends that traditional education does not effectively teach individuals how to build wealth, encouraging readers instead to invest in assets that produce passive income while minimising liabilities – and stressing the importance of financial independence.

Kiyosaki recalls how both his poor dad and rich dad provided different advice regarding financial matters; poor dad stressed hard work and education while rich dad emphasized understanding the intricacies of money management.

Rich Dad taught Kiyosaki how to become an investor rather than just a consumer. According to him, in order to be an effective investor one needs four components of what is called financial intelligence – accounting, investing strategy, market law and investment packages – in order to be an effective investor and find opportunities other investors miss as well as mobilizing smart people who can assist you make deals.

Chapter 6: Financial Independence

Kiyosaki talks about two father figures who influenced his views of money and wealth. One, commonly referred to as his “poor dad”, held conventional ideas such as excelling academically and finding employment which provided financial security.

Rich Dad was self-made and focused on building assets that generated passive income, such as real estate investments. He taught the author that while life pushes everyone in different directions, some find ways to thrive and get ahead by taking an alternative path than most.

Kiyosaki asserts that many individuals become trapped in the rat race due to failing to learn about wealth-building strategies such as investing. Traditional education neglects teaching these principles, which may explain why so many struggle financially.